Table of contents

Subscribe to DVS 2024

Sign up now to get access to the library of members-only issues.

The Financial Landscape of 2025: The Increasing Convergence of TradFi and DeFi

The Financial Landscape of 2025: The Increasing Convergence of TradFi and DeFi

The Financial Landscape of 2025: The Increasing Convergence of TradFi and DeFi

Insights & Trends

Insights & Trends

7 minutes

7 minutes

Sep 27, 2024

Sep 27, 2024

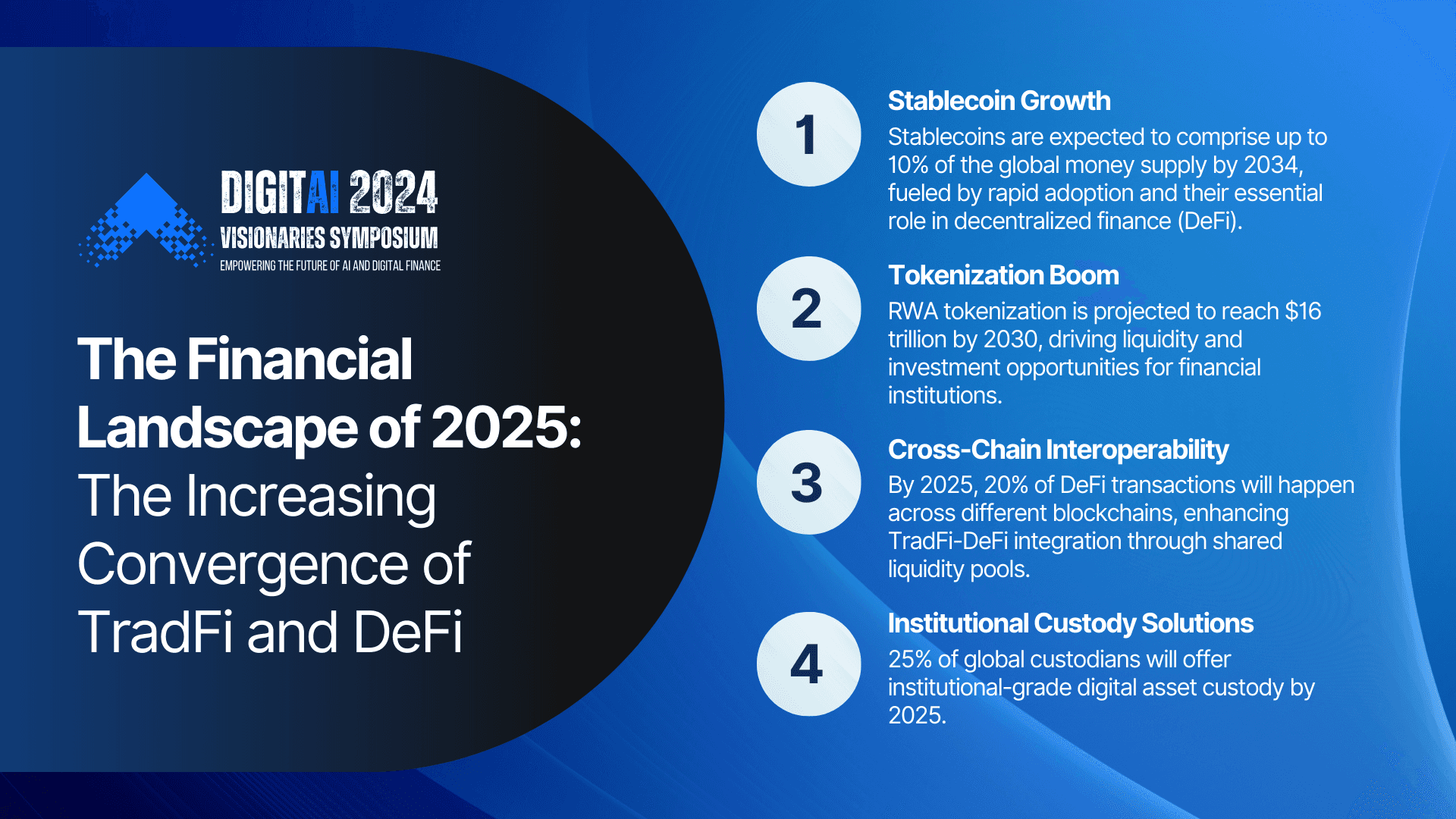

Stablecoins are projected to account for as much as 10% of the global money supply by 2034. As the DeFi ecosystem matures, stablecoins are essential for facilitating transactions, providing liquidity, and enabling innovative financial products.

Tokenization of real-world assets (RWAs) is expected to reach $16 trillion by 2030, unlocking new liquidity and investment opportunities for financial institutions. By 2025, 25% of global custodians are expected to provide institutional-grade digital assets custody solutions, driving further adoption of DeFi by traditional finance (TradFi) institutions.

Join industry leaders at the Digital Visionaries Symposium 2024 on October 25, 2024, for the panel – “ The Outlook for Financial Ecosystems in 2025: TradFi and DeFi Integration”. Experts will discuss blockchain innovations, strategies for interoperability, and its impact on financial markets and regulations.

Stablecoins are projected to account for as much as 10% of the global money supply by 2034. As the DeFi ecosystem matures, stablecoins are essential for facilitating transactions, providing liquidity, and enabling innovative financial products.

Tokenization of real-world assets (RWAs) is expected to reach $16 trillion by 2030, unlocking new liquidity and investment opportunities for financial institutions. By 2025, 25% of global custodians are expected to provide institutional-grade digital assets custody solutions, driving further adoption of DeFi by traditional finance (TradFi) institutions.

Join industry leaders at the Digital Visionaries Symposium 2024 on October 25, 2024, for the panel – “ The Outlook for Financial Ecosystems in 2025: TradFi and DeFi Integration”. Experts will discuss blockchain innovations, strategies for interoperability, and its impact on financial markets and regulations.

Stablecoins are projected to account for as much as 10% of the global money supply by 2034. As the DeFi ecosystem matures, stablecoins are essential for facilitating transactions, providing liquidity, and enabling innovative financial products.

Tokenization of real-world assets (RWAs) is expected to reach $16 trillion by 2030, unlocking new liquidity and investment opportunities for financial institutions. By 2025, 25% of global custodians are expected to provide institutional-grade digital assets custody solutions, driving further adoption of DeFi by traditional finance (TradFi) institutions.

Join industry leaders at the Digital Visionaries Symposium 2024 on October 25, 2024, for the panel – “ The Outlook for Financial Ecosystems in 2025: TradFi and DeFi Integration”. Experts will discuss blockchain innovations, strategies for interoperability, and its impact on financial markets and regulations.

The increasing convergence of traditional finance (TradFi) and decentralized finance (DeFi) is set to transform the global financial ecosystem. Jeremy Allaire, CEO of Circle, forecasts that stablecoins may constitute up to 10% of the world’s money supply by 2034.

As global banks and regulatory frameworks evolve to accommodate blockchain technology, the integration of these two worlds is inevitable. This insight examines the trends driving this shift, the evolving regulatory landscape, and the opportunities it presents for financial leaders to thrive in a progressively hybrid financial ecosystem.

The increasing convergence of traditional finance (TradFi) and decentralized finance (DeFi) is set to transform the global financial ecosystem. Jeremy Allaire, CEO of Circle, forecasts that stablecoins may constitute up to 10% of the world’s money supply by 2034.

As global banks and regulatory frameworks evolve to accommodate blockchain technology, the integration of these two worlds is inevitable. This insight examines the trends driving this shift, the evolving regulatory landscape, and the opportunities it presents for financial leaders to thrive in a progressively hybrid financial ecosystem.

The increasing convergence of traditional finance (TradFi) and decentralized finance (DeFi) is set to transform the global financial ecosystem. Jeremy Allaire, CEO of Circle, forecasts that stablecoins may constitute up to 10% of the world’s money supply by 2034.

As global banks and regulatory frameworks evolve to accommodate blockchain technology, the integration of these two worlds is inevitable. This insight examines the trends driving this shift, the evolving regulatory landscape, and the opportunities it presents for financial leaders to thrive in a progressively hybrid financial ecosystem.

2023 to 2025: Increasing TradFi-DeFi Integration

2023 to 2025: Increasing TradFi-DeFi Integration

2023 to 2025: Increasing TradFi-DeFi Integration

The adoption of blockchain technology in finance is accelerating, with 88% of major global banks either announcing or exploring blockchain-based services. This reflects a strategic pivot from viewing blockchain as a disruption to recognizing it as a tool for modernizing financial infrastructure.

Case study: Streamlining cross-border payments

The adoption of blockchain technology is streamlining cross-border payments, traditionally affected by high costs and delays.

JPMorgan’s Onyx platform: Onyx uses JPM Coin to settle transactions in real-time, reducing settlement times by 80% and cut transaction fees by millions.

Visa and Mastercard: Both companies are expanding blockchain services, offering digital asset payment options to capture a share of the growing digital asset market.

The regulatory environment is also evolving. As governments introduce clearer rules for crypto assets, such as the EU’s MiCA regulation (expected by 2024), financial institutions are more confident in adopting decentralized technologies. Over the next two years, DeFi is expected to become embedded in TradFi operations, with blockchain serving as the backbone for faster, cheaper, and more secure financial services.

The adoption of blockchain technology in finance is accelerating, with 88% of major global banks either announcing or exploring blockchain-based services. This reflects a strategic pivot from viewing blockchain as a disruption to recognizing it as a tool for modernizing financial infrastructure.

Case study: Streamlining cross-border payments

The adoption of blockchain technology is streamlining cross-border payments, traditionally affected by high costs and delays.

JPMorgan’s Onyx platform: Onyx uses JPM Coin to settle transactions in real-time, reducing settlement times by 80% and cut transaction fees by millions.

Visa and Mastercard: Both companies are expanding blockchain services, offering digital asset payment options to capture a share of the growing digital asset market.

The regulatory environment is also evolving. As governments introduce clearer rules for crypto assets, such as the EU’s MiCA regulation (expected by 2024), financial institutions are more confident in adopting decentralized technologies. Over the next two years, DeFi is expected to become embedded in TradFi operations, with blockchain serving as the backbone for faster, cheaper, and more secure financial services.

The adoption of blockchain technology in finance is accelerating, with 88% of major global banks either announcing or exploring blockchain-based services. This reflects a strategic pivot from viewing blockchain as a disruption to recognizing it as a tool for modernizing financial infrastructure.

Case study: Streamlining cross-border payments

The adoption of blockchain technology is streamlining cross-border payments, traditionally affected by high costs and delays.

JPMorgan’s Onyx platform: Onyx uses JPM Coin to settle transactions in real-time, reducing settlement times by 80% and cut transaction fees by millions.

Visa and Mastercard: Both companies are expanding blockchain services, offering digital asset payment options to capture a share of the growing digital asset market.

The regulatory environment is also evolving. As governments introduce clearer rules for crypto assets, such as the EU’s MiCA regulation (expected by 2024), financial institutions are more confident in adopting decentralized technologies. Over the next two years, DeFi is expected to become embedded in TradFi operations, with blockchain serving as the backbone for faster, cheaper, and more secure financial services.

2025 Outlook: Key Drivers of TradFi and DeFi Convergence

2025 Outlook: Key Drivers of TradFi and DeFi Convergence

2025 Outlook: Key Drivers of TradFi and DeFi Convergence

By 2025, several key trends will accelerate the convergence of TradFi and DeFi:

Tokenization of Real-World Assets (RWAs)

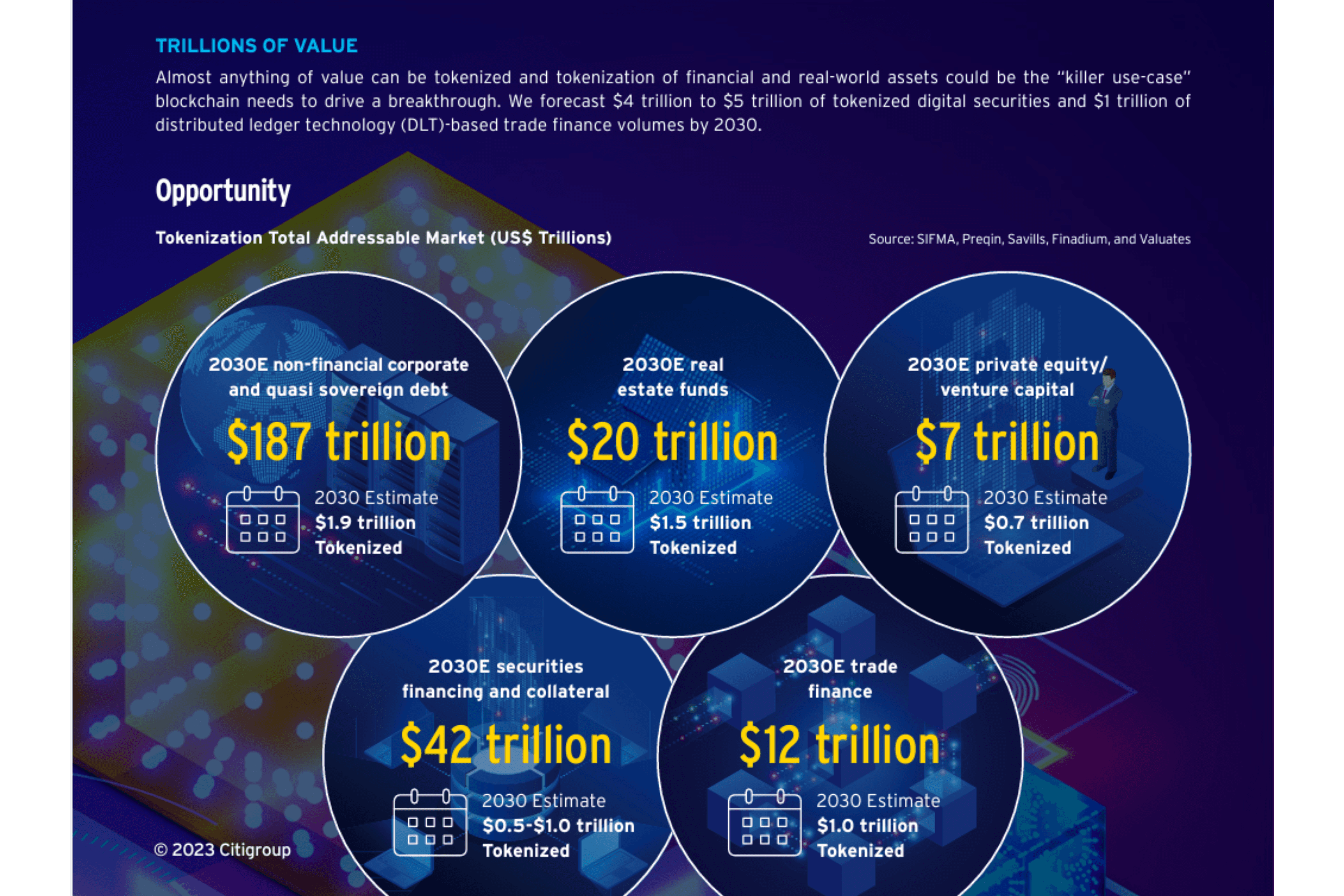

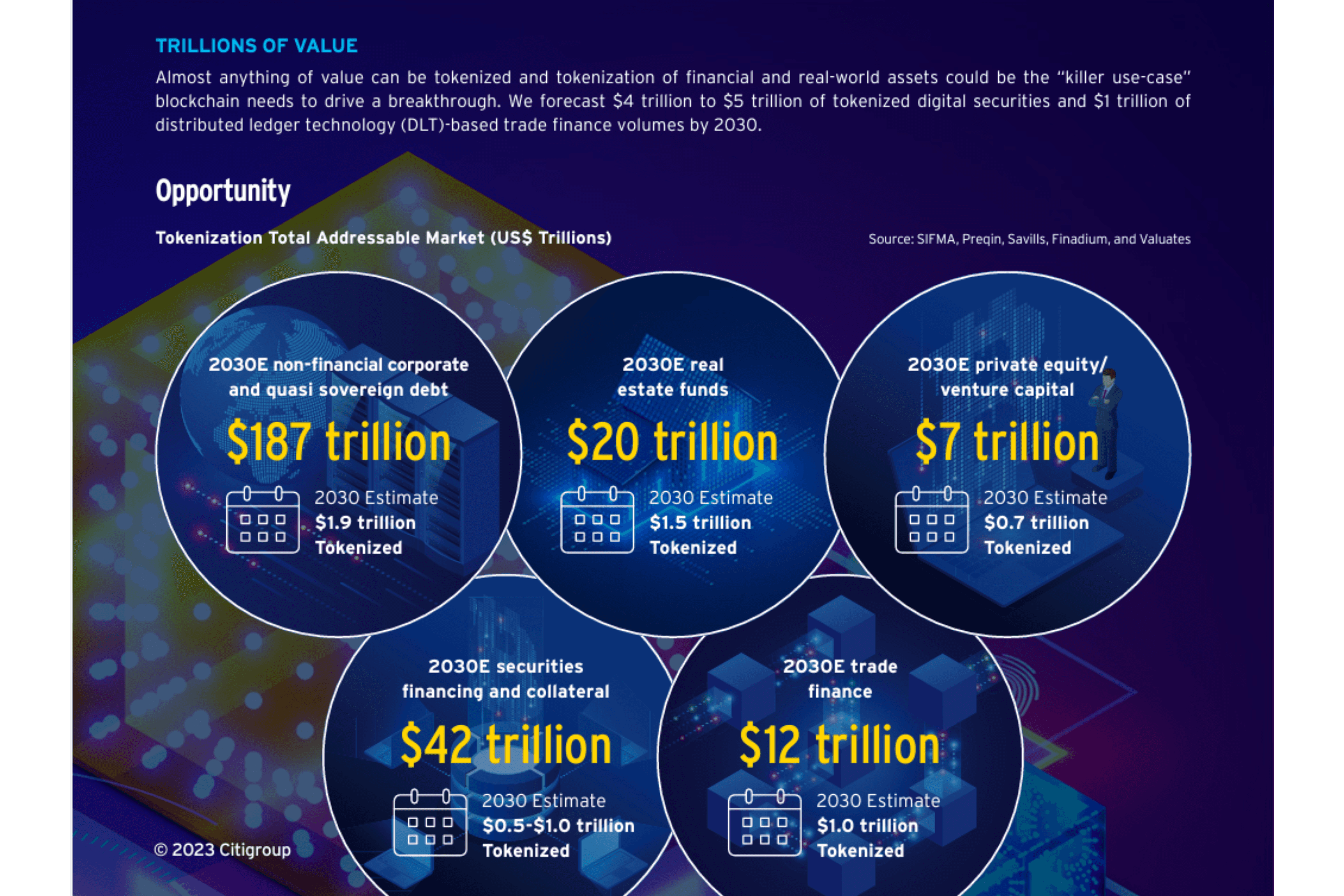

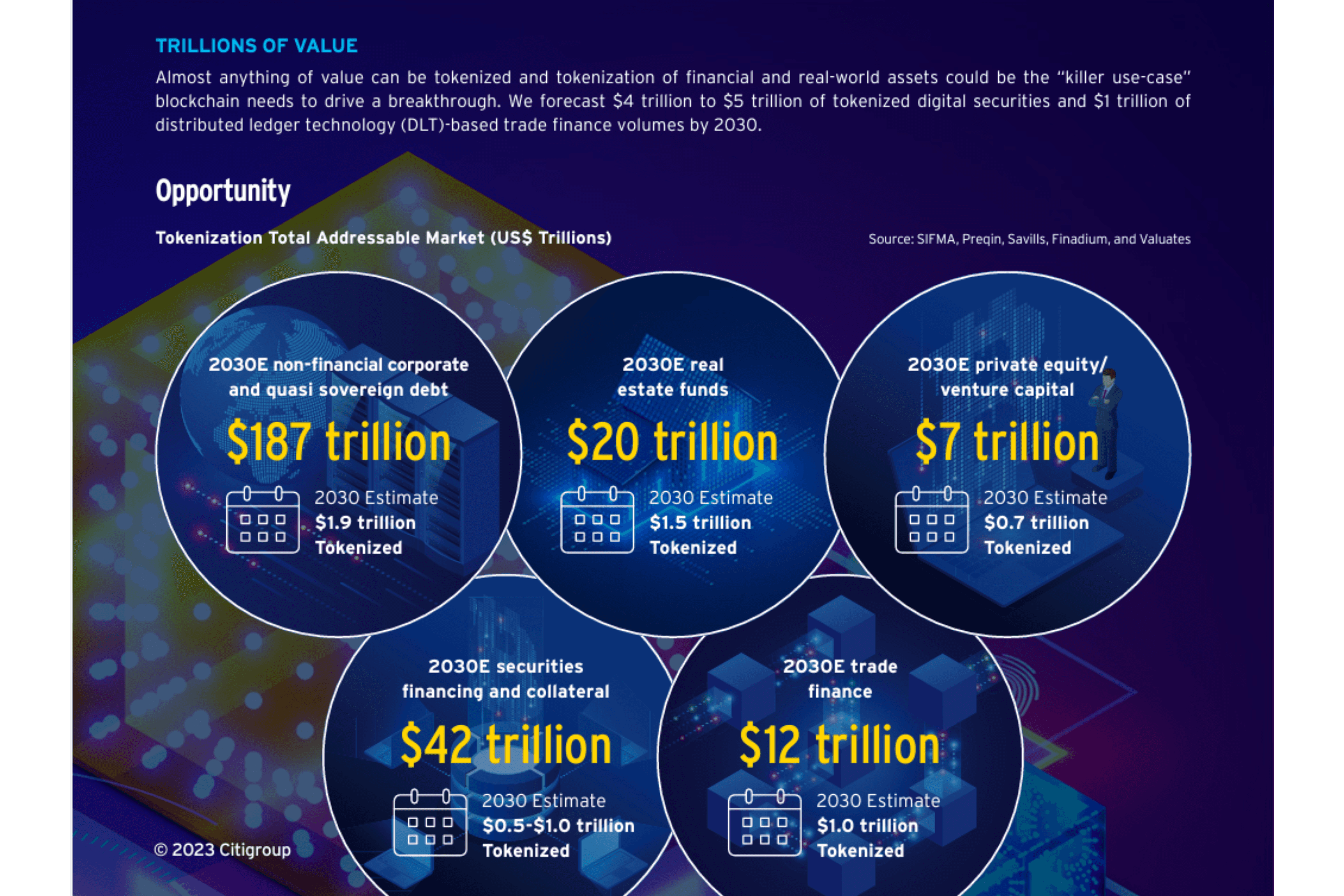

Tokenization is emerging as one of the most promising application of blockchain within TradFi. Tokenized assets—such as real estate, bonds, commodities—provide increased liquidity, transparency, and lower transaction costs. The tokenized RWA market is projected to reach $10 trillion by 2030, driven by major financial institutions such as Fidelity and BlackRock, which are developing tokenized investment products to diversify portfolios. This gives investors greater access to assets that were once illiquid, improving risk distribution and capital efficiency.

Source: Citigroup

Cross-Chain Interoperability

The challenge of blockchain ecosystems operating independently is being solved through cross-chain solutions, enabling decentralized applications (dApps) and tokens to function across different blockchains. By 2025, 20% of all DeFi transactions are expected to occur across chains, with Ethereum at the forefront. This growing interoperability will bridge DeFi and TradFi, allowing shared liquidity pools and the creation of hybrid financial products that leverage both systems.

Institutional-Grade Custody and Security Solutions

Institutional adoption of blockchain technology has been limited by concerns over asset security. With the rise of regulated, institutional-grade digital asset custody solutions, this barrier is diminishing. By 2025, 25% of global custodians, including firms such as State Street and BNY Mellon, will offer fully compliant custody services for digital assets, enabling institutional investors to securely hold these assets.

By 2025, several key trends will accelerate the convergence of TradFi and DeFi:

Tokenization of Real-World Assets (RWAs)

Tokenization is emerging as one of the most promising application of blockchain within TradFi. Tokenized assets—such as real estate, bonds, commodities—provide increased liquidity, transparency, and lower transaction costs. The tokenized RWA market is projected to reach $10 trillion by 2030, driven by major financial institutions such as Fidelity and BlackRock, which are developing tokenized investment products to diversify portfolios. This gives investors greater access to assets that were once illiquid, improving risk distribution and capital efficiency.

Source: Citigroup

Cross-Chain Interoperability

The challenge of blockchain ecosystems operating independently is being solved through cross-chain solutions, enabling decentralized applications (dApps) and tokens to function across different blockchains. By 2025, 20% of all DeFi transactions are expected to occur across chains, with Ethereum at the forefront. This growing interoperability will bridge DeFi and TradFi, allowing shared liquidity pools and the creation of hybrid financial products that leverage both systems.

Institutional-Grade Custody and Security Solutions

Institutional adoption of blockchain technology has been limited by concerns over asset security. With the rise of regulated, institutional-grade digital asset custody solutions, this barrier is diminishing. By 2025, 25% of global custodians, including firms such as State Street and BNY Mellon, will offer fully compliant custody services for digital assets, enabling institutional investors to securely hold these assets.

By 2025, several key trends will accelerate the convergence of TradFi and DeFi:

Tokenization of Real-World Assets (RWAs)

Tokenization is emerging as one of the most promising application of blockchain within TradFi. Tokenized assets—such as real estate, bonds, commodities—provide increased liquidity, transparency, and lower transaction costs. The tokenized RWA market is projected to reach $10 trillion by 2030, driven by major financial institutions such as Fidelity and BlackRock, which are developing tokenized investment products to diversify portfolios. This gives investors greater access to assets that were once illiquid, improving risk distribution and capital efficiency.

Source: Citigroup

Cross-Chain Interoperability

The challenge of blockchain ecosystems operating independently is being solved through cross-chain solutions, enabling decentralized applications (dApps) and tokens to function across different blockchains. By 2025, 20% of all DeFi transactions are expected to occur across chains, with Ethereum at the forefront. This growing interoperability will bridge DeFi and TradFi, allowing shared liquidity pools and the creation of hybrid financial products that leverage both systems.

Institutional-Grade Custody and Security Solutions

Institutional adoption of blockchain technology has been limited by concerns over asset security. With the rise of regulated, institutional-grade digital asset custody solutions, this barrier is diminishing. By 2025, 25% of global custodians, including firms such as State Street and BNY Mellon, will offer fully compliant custody services for digital assets, enabling institutional investors to securely hold these assets.

Case Studies: Real-World Examples of TradFi and DeFi Convergence

Case Studies: Real-World Examples of TradFi and DeFi Convergence

Case Studies: Real-World Examples of TradFi and DeFi Convergence

Several examples demonstrate how traditional finance (TradFi) and decentralized finance (DeFi) are increasingly merging, reflecting a broader trend toward hybridization in the financial industry:

Citi’s Tokenized Deposits: Citi is leveraging blockchain technology to create tokenized deposits, aiming to enhance the transparency and efficiency of financial transactions. These tokenized deposits are part of Citi's efforts within the Regulated Liability Network (RLN), an initiative that seeks to innovate in the realm of tokenized money for institutional use. One of the primary features of Citi’s tokenized deposit system is the facilitation of 24/7 cross-border payments, which significantly speeds up settlement times and enhances liquidity for institutional clients.

HSBC’s Tokenized Gold: HSBC has introduced tokenized gold, providing digital ownership backed by physical reserves. The tokenization process is powered by blockchain, ensuring the transparency, security, and traceability of every transaction. One of the key benefits of HSBC's tokenized gold is its flexibility. Customers can easily buy, sell, or redeem their tokens for physical gold at any time, which provides higher liquidity than traditional gold investments.

DigiFT's Blockchain-Based Treasury Bill Tokens: DigiFT has introduced the first blockchain-based depository receipt tokens linked to US Treasury Bills, providing increased access, transparency, and regulatory compliance for institutions.

Chainlink’s CCIP for Programmable Token Transfers: Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enables secure and programmable token transfers across multiple blockchain networks, enhancing the functionality of decentralized applications (dApps) and enabling more complex use cases in both decentralized finance (DeFi) and traditional finance. One of the primary goals of CCIP is to become the standard for cross-chain bridges, providing security and flexibility for various financial operations.

Goldman Sachs Crypto Desk: Goldman Sachs has facilitated access to DeFi products such as yield-generating crypto assets and tokenized securities. By 2025, Goldman’s crypto trading division is expected to handle $15 billion in digital assets.

Several examples demonstrate how traditional finance (TradFi) and decentralized finance (DeFi) are increasingly merging, reflecting a broader trend toward hybridization in the financial industry:

Citi’s Tokenized Deposits: Citi is leveraging blockchain technology to create tokenized deposits, aiming to enhance the transparency and efficiency of financial transactions. These tokenized deposits are part of Citi's efforts within the Regulated Liability Network (RLN), an initiative that seeks to innovate in the realm of tokenized money for institutional use. One of the primary features of Citi’s tokenized deposit system is the facilitation of 24/7 cross-border payments, which significantly speeds up settlement times and enhances liquidity for institutional clients.

HSBC’s Tokenized Gold: HSBC has introduced tokenized gold, providing digital ownership backed by physical reserves. The tokenization process is powered by blockchain, ensuring the transparency, security, and traceability of every transaction. One of the key benefits of HSBC's tokenized gold is its flexibility. Customers can easily buy, sell, or redeem their tokens for physical gold at any time, which provides higher liquidity than traditional gold investments.

DigiFT's Blockchain-Based Treasury Bill Tokens: DigiFT has introduced the first blockchain-based depository receipt tokens linked to US Treasury Bills, providing increased access, transparency, and regulatory compliance for institutions.

Chainlink’s CCIP for Programmable Token Transfers: Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enables secure and programmable token transfers across multiple blockchain networks, enhancing the functionality of decentralized applications (dApps) and enabling more complex use cases in both decentralized finance (DeFi) and traditional finance. One of the primary goals of CCIP is to become the standard for cross-chain bridges, providing security and flexibility for various financial operations.

Goldman Sachs Crypto Desk: Goldman Sachs has facilitated access to DeFi products such as yield-generating crypto assets and tokenized securities. By 2025, Goldman’s crypto trading division is expected to handle $15 billion in digital assets.

Several examples demonstrate how traditional finance (TradFi) and decentralized finance (DeFi) are increasingly merging, reflecting a broader trend toward hybridization in the financial industry:

Citi’s Tokenized Deposits: Citi is leveraging blockchain technology to create tokenized deposits, aiming to enhance the transparency and efficiency of financial transactions. These tokenized deposits are part of Citi's efforts within the Regulated Liability Network (RLN), an initiative that seeks to innovate in the realm of tokenized money for institutional use. One of the primary features of Citi’s tokenized deposit system is the facilitation of 24/7 cross-border payments, which significantly speeds up settlement times and enhances liquidity for institutional clients.

HSBC’s Tokenized Gold: HSBC has introduced tokenized gold, providing digital ownership backed by physical reserves. The tokenization process is powered by blockchain, ensuring the transparency, security, and traceability of every transaction. One of the key benefits of HSBC's tokenized gold is its flexibility. Customers can easily buy, sell, or redeem their tokens for physical gold at any time, which provides higher liquidity than traditional gold investments.

DigiFT's Blockchain-Based Treasury Bill Tokens: DigiFT has introduced the first blockchain-based depository receipt tokens linked to US Treasury Bills, providing increased access, transparency, and regulatory compliance for institutions.

Chainlink’s CCIP for Programmable Token Transfers: Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enables secure and programmable token transfers across multiple blockchain networks, enhancing the functionality of decentralized applications (dApps) and enabling more complex use cases in both decentralized finance (DeFi) and traditional finance. One of the primary goals of CCIP is to become the standard for cross-chain bridges, providing security and flexibility for various financial operations.

Goldman Sachs Crypto Desk: Goldman Sachs has facilitated access to DeFi products such as yield-generating crypto assets and tokenized securities. By 2025, Goldman’s crypto trading division is expected to handle $15 billion in digital assets.

The evolution of regulatory frameworks will be a critical factor in shaping how these ecosystems coexist. The European Union’s MiCA regulation will likely be a blueprint for other regions, establishing clear guidelines for crypto assets, stablecoins, and DeFi protocols. This framework addresses consumer protection, anti-money laundering (AML), and operational risk management.

For institutional investors, the convergence of DeFi and TradFi presents significant opportunities for portfolio diversification and risk management. By 2025, 70% of institutional investors are expected to hold decentralized assets, driven by the promise of higher returns, innovative yield mechanisms, and enhanced liquidity.

The evolution of regulatory frameworks will be a critical factor in shaping how these ecosystems coexist. The European Union’s MiCA regulation will likely be a blueprint for other regions, establishing clear guidelines for crypto assets, stablecoins, and DeFi protocols. This framework addresses consumer protection, anti-money laundering (AML), and operational risk management.

For institutional investors, the convergence of DeFi and TradFi presents significant opportunities for portfolio diversification and risk management. By 2025, 70% of institutional investors are expected to hold decentralized assets, driven by the promise of higher returns, innovative yield mechanisms, and enhanced liquidity.

The evolution of regulatory frameworks will be a critical factor in shaping how these ecosystems coexist. The European Union’s MiCA regulation will likely be a blueprint for other regions, establishing clear guidelines for crypto assets, stablecoins, and DeFi protocols. This framework addresses consumer protection, anti-money laundering (AML), and operational risk management.

For institutional investors, the convergence of DeFi and TradFi presents significant opportunities for portfolio diversification and risk management. By 2025, 70% of institutional investors are expected to hold decentralized assets, driven by the promise of higher returns, innovative yield mechanisms, and enhanced liquidity.

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights

& Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong