Table of contents

Subscribe to DVS 2024

Sign up now to get access to the library of members-only issues.

Financing the Future: Capital Dynamics in Emerging Tech Sectors

Financing the Future: Capital Dynamics in Emerging Tech Sectors

Financing the Future: Capital Dynamics in Emerging Tech Sectors

Insights & Trends

Insights & Trends

7 minutes

7 minutes

Aug 29, 2024

Aug 29, 2024

Institutional investors must act decisively to capitalize on high-growth sectors like AI, FinTech, and blockchain – which are reshaping traditional industries and creating entirely new markets.

Recognizing and managing the inherent volatility and regulatory complexities in emerging tech sectors is key to staying ahead the curve.

Stay informed and connect with industry leaders at the Digital Visionaries Symposium 2024. The panel on "Financing the Future: Capital Dynamics in Emerging Tech Sectors," headlined by CIOs and leading institutional investors, will take place on the morning of October 24, 2024. Join us in Hong Kong or online to gain actionable insights for navigating AI and digital finance.

Institutional investors must act decisively to capitalize on high-growth sectors like AI, FinTech, and blockchain – which are reshaping traditional industries and creating entirely new markets.

Recognizing and managing the inherent volatility and regulatory complexities in emerging tech sectors is key to staying ahead the curve.

Stay informed and connect with industry leaders at the Digital Visionaries Symposium 2024. The panel on "Financing the Future: Capital Dynamics in Emerging Tech Sectors," headlined by CIOs and leading institutional investors, will take place on the morning of October 24, 2024. Join us in Hong Kong or online to gain actionable insights for navigating AI and digital finance.

Institutional investors must act decisively to capitalize on high-growth sectors like AI, FinTech, and blockchain – which are reshaping traditional industries and creating entirely new markets.

Recognizing and managing the inherent volatility and regulatory complexities in emerging tech sectors is key to staying ahead the curve.

Stay informed and connect with industry leaders at the Digital Visionaries Symposium 2024. The panel on "Financing the Future: Capital Dynamics in Emerging Tech Sectors," headlined by CIOs and leading institutional investors, will take place on the morning of October 24, 2024. Join us in Hong Kong or online to gain actionable insights for navigating AI and digital finance.

Title - Paragraph 1

Title - Paragraph 1

Title - Paragraph 1

Frontier technologies are reshaping innovation and creating unprecedented investment opportunities. For institutional investors, the focus is on rapid engagement with these technologies. The urgency to invest in high-growth sectors, manage risks, and explore new avenues is critical as we enter this new era of disruption.

Frontier technologies are reshaping innovation and creating unprecedented investment opportunities. For institutional investors, the focus is on rapid engagement with these technologies. The urgency to invest in high-growth sectors, manage risks, and explore new avenues is critical as we enter this new era of disruption.

Frontier technologies are reshaping innovation and creating unprecedented investment opportunities. For institutional investors, the focus is on rapid engagement with these technologies. The urgency to invest in high-growth sectors, manage risks, and explore new avenues is critical as we enter this new era of disruption.

The Rise of Frontier Technologies

The Rise of Frontier Technologies

The Rise of Frontier Technologies

Frontier technologies like AI, blockchain, and quantum computing are rapidly advancing and becoming integral across industries, from aerospace to retail (McKinsey Technology Trends Outlook 2024). Understanding these capital and fund flow dynamics is essential for navigating investment opportunities and managing risks in the evolving tech landscape.

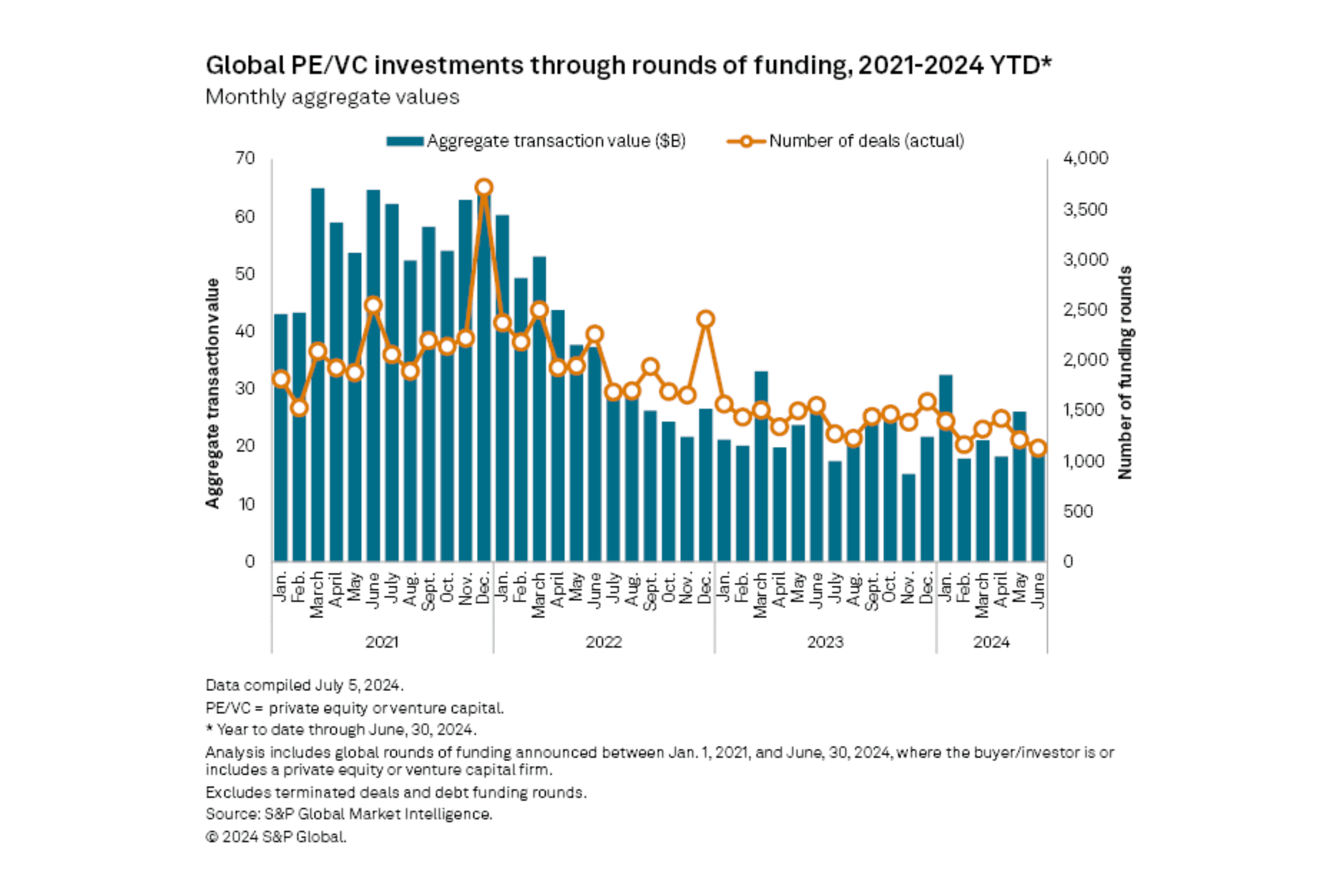

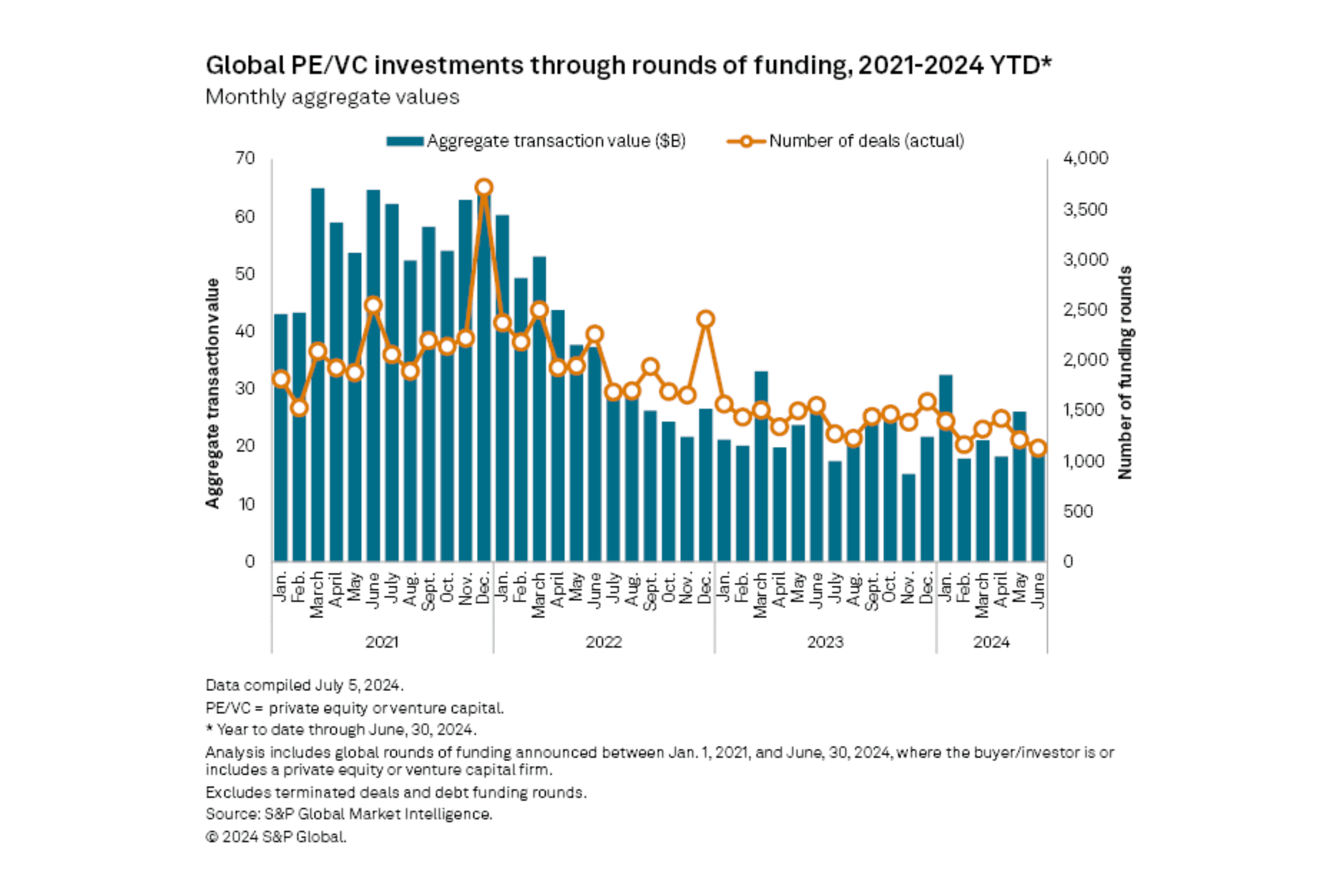

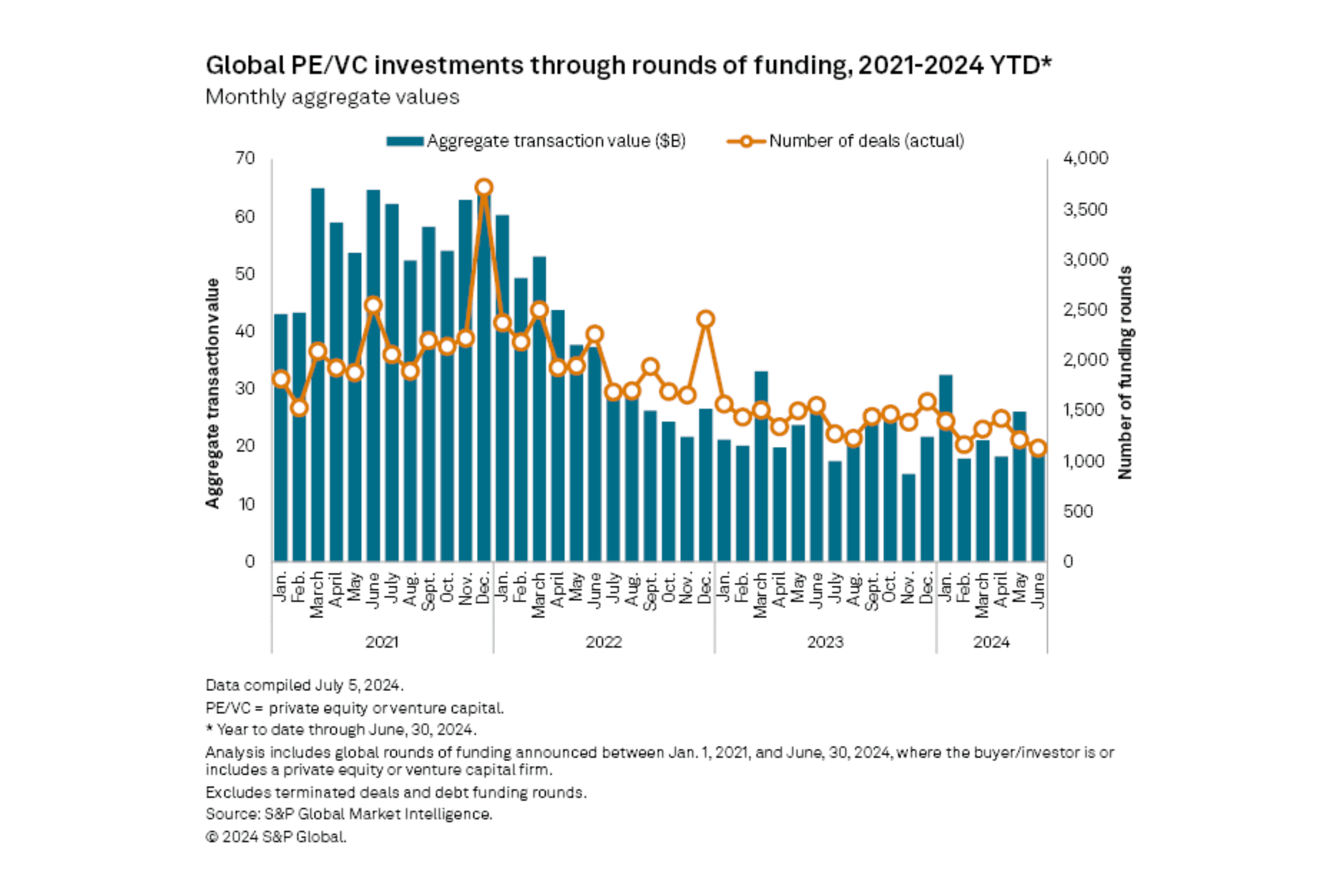

Venture Capital Allocation: Early-stage innovations in these technologies rely on venture capital (VC) and private equity (PE). However, recent data from S&P Global shows a slowdown in VC, with deal value dropping to $65.41 billion in Q2 2024, an 8.3% decline year-over-year. The number of transactions also fell by 14.3%, signaling caution and market saturation.

Secondary Market Dynamics: As technologies mature, secondary markets become crucial for continued investment. The interplay between primary (early-stage) and secondary (mature-stage) markets balances risk and opportunity. Primary markets drive initial innovation, while secondary markets provide liquidity and valuation for scaling businesses.

Source: S&P Global

Frontier technologies like AI, blockchain, and quantum computing are rapidly advancing and becoming integral across industries, from aerospace to retail (McKinsey Technology Trends Outlook 2024). Understanding these capital and fund flow dynamics is essential for navigating investment opportunities and managing risks in the evolving tech landscape.

Venture Capital Allocation: Early-stage innovations in these technologies rely on venture capital (VC) and private equity (PE). However, recent data from S&P Global shows a slowdown in VC, with deal value dropping to $65.41 billion in Q2 2024, an 8.3% decline year-over-year. The number of transactions also fell by 14.3%, signaling caution and market saturation.

Secondary Market Dynamics: As technologies mature, secondary markets become crucial for continued investment. The interplay between primary (early-stage) and secondary (mature-stage) markets balances risk and opportunity. Primary markets drive initial innovation, while secondary markets provide liquidity and valuation for scaling businesses.

Source: S&P Global

Frontier technologies like AI, blockchain, and quantum computing are rapidly advancing and becoming integral across industries, from aerospace to retail (McKinsey Technology Trends Outlook 2024). Understanding these capital and fund flow dynamics is essential for navigating investment opportunities and managing risks in the evolving tech landscape.

Venture Capital Allocation: Early-stage innovations in these technologies rely on venture capital (VC) and private equity (PE). However, recent data from S&P Global shows a slowdown in VC, with deal value dropping to $65.41 billion in Q2 2024, an 8.3% decline year-over-year. The number of transactions also fell by 14.3%, signaling caution and market saturation.

Secondary Market Dynamics: As technologies mature, secondary markets become crucial for continued investment. The interplay between primary (early-stage) and secondary (mature-stage) markets balances risk and opportunity. Primary markets drive initial innovation, while secondary markets provide liquidity and valuation for scaling businesses.

Source: S&P Global

Pinpointing High-Growth Sectors To Maximize Returns

Pinpointing High-Growth Sectors To Maximize Returns

Pinpointing High-Growth Sectors To Maximize Returns

In an era of rapid technological advancement, identifying high-growth sectors is crucial for institutional investors seeking to maximize returns. Key areas to focus on include:

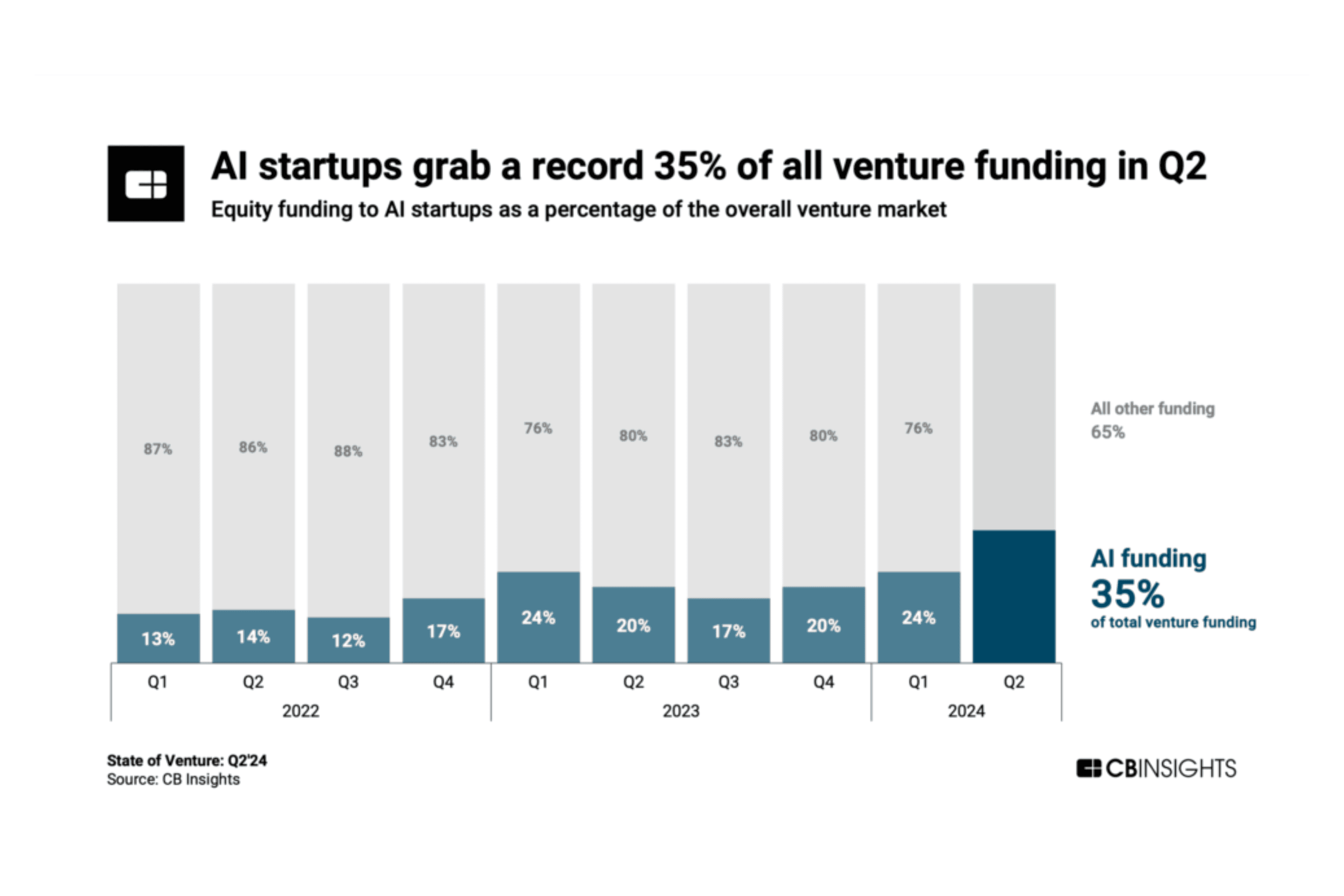

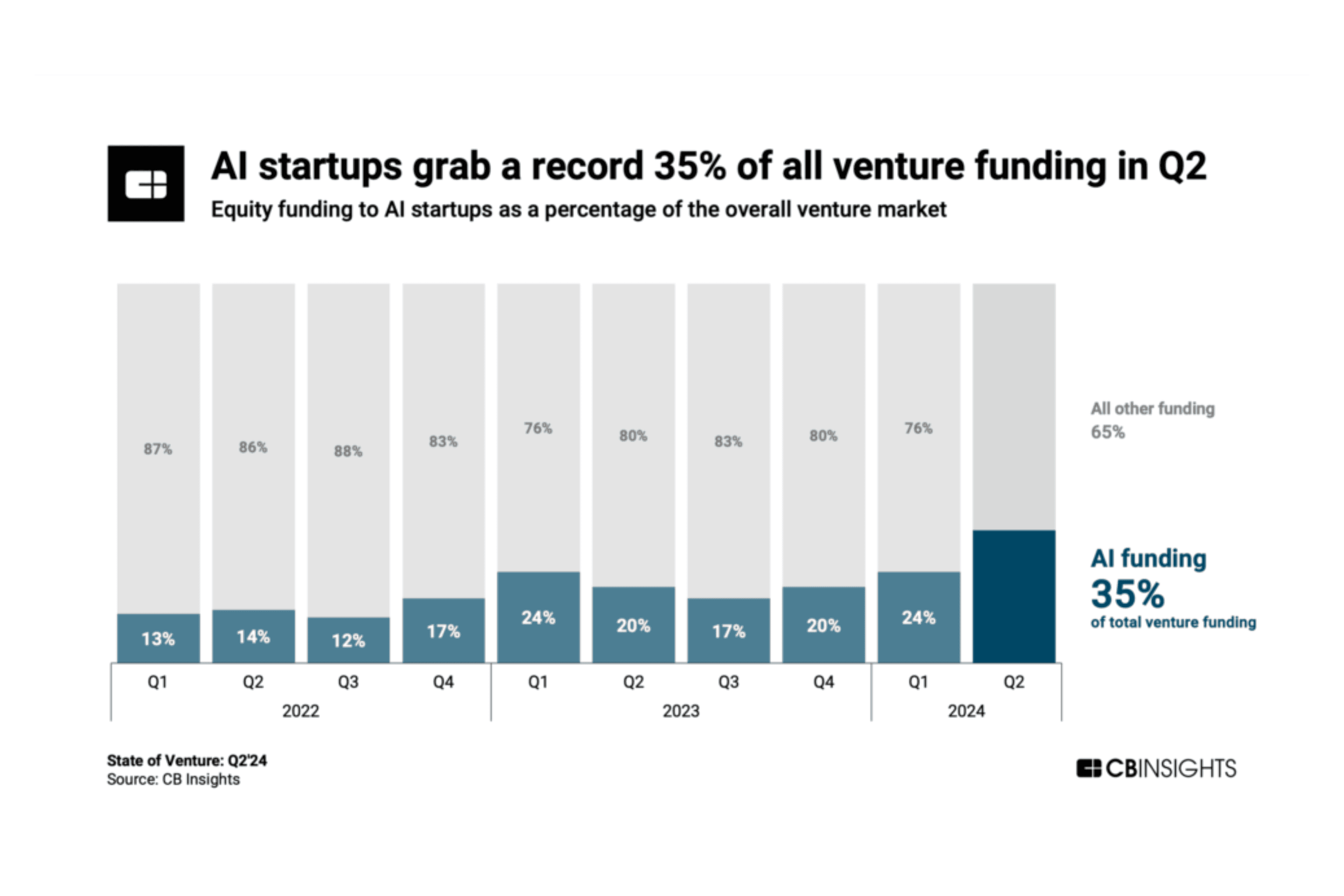

AI

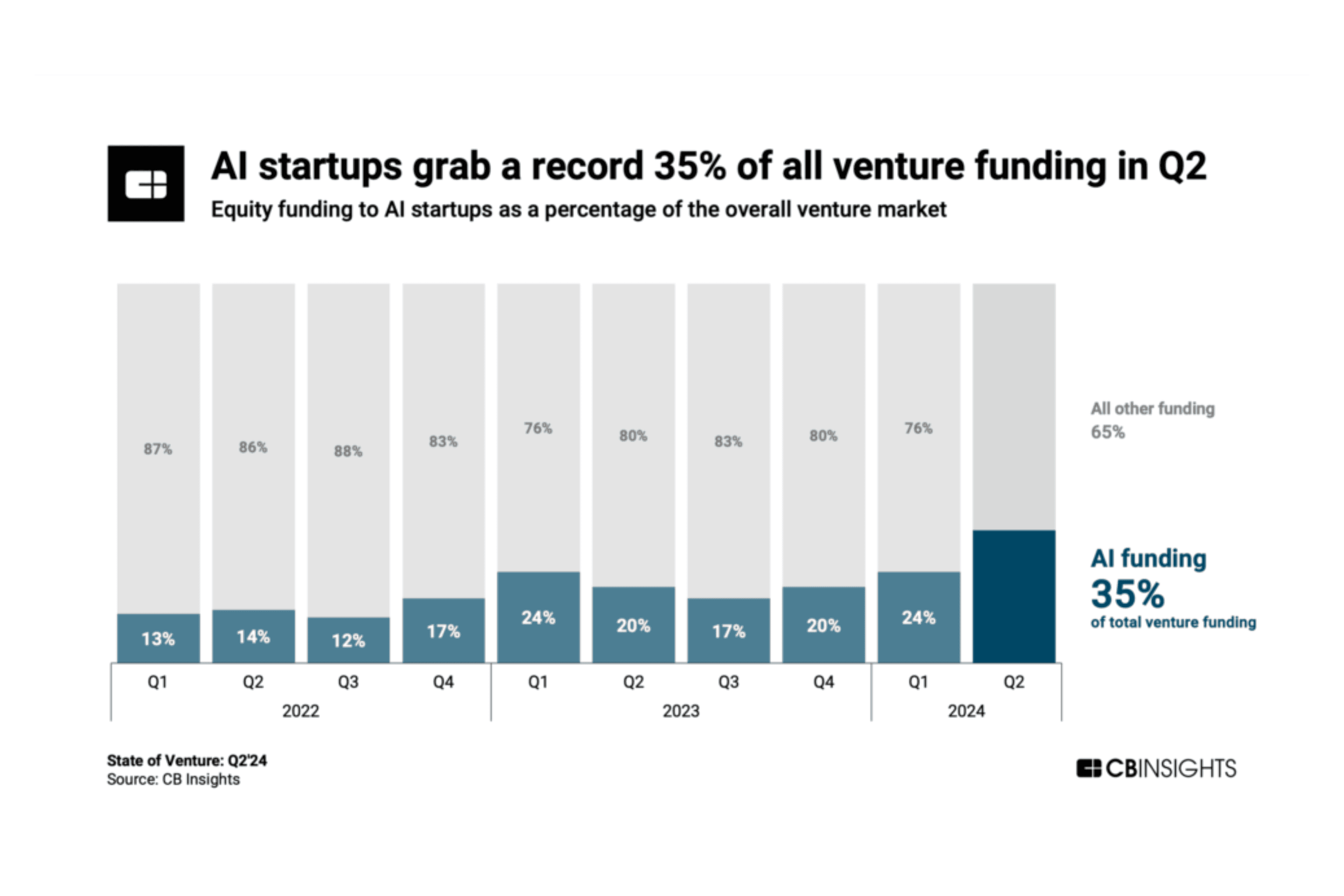

AI startups are driving substantial gains. In Q2 2024, AI-focused startups secured $23.2 billion, capturing 35% of global VC, a record high. Notably, Elon Musk’s xAI raised $6 billion and is valued at $24 billion, reflecting AI's central role in future investments.

Source: CBInsights

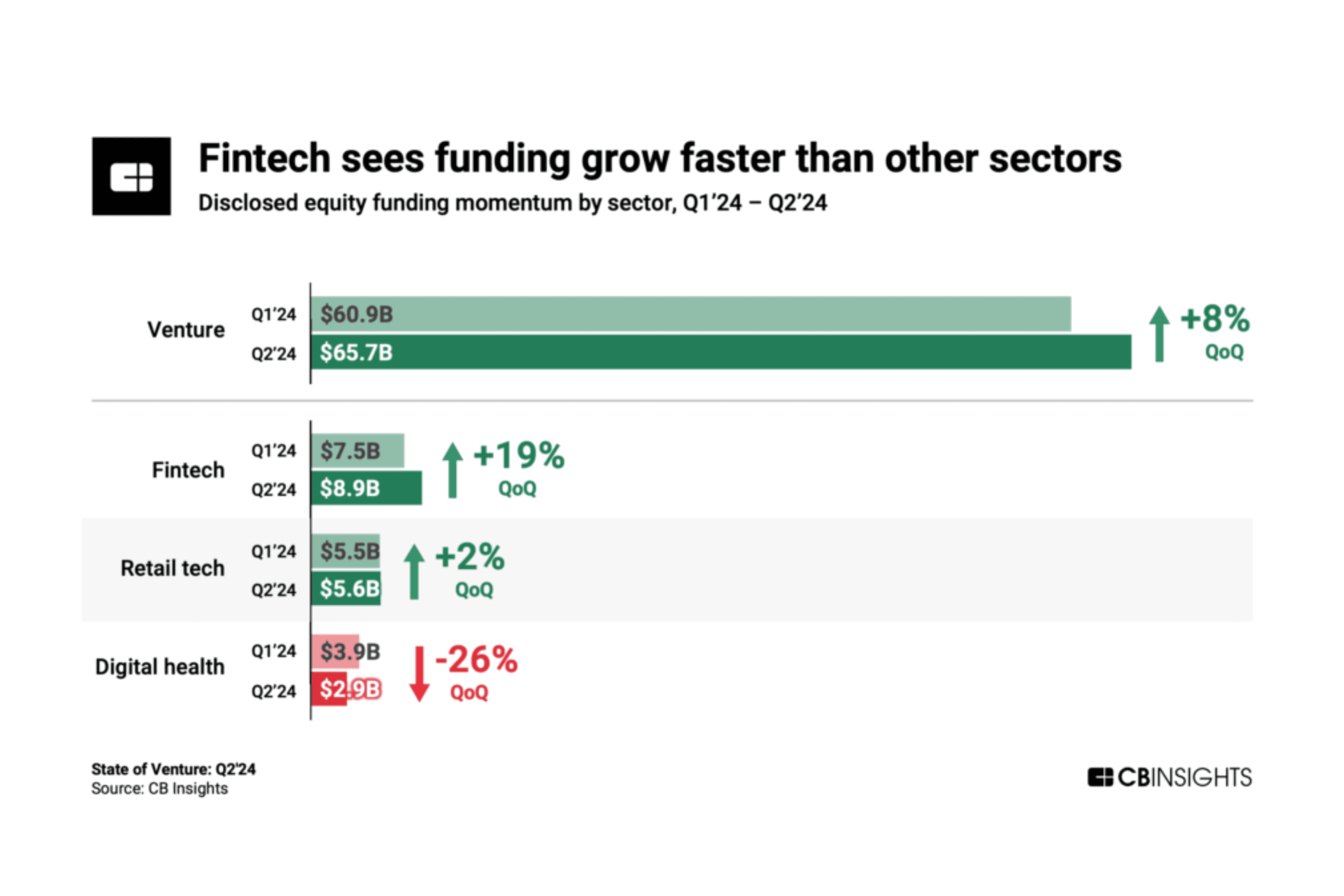

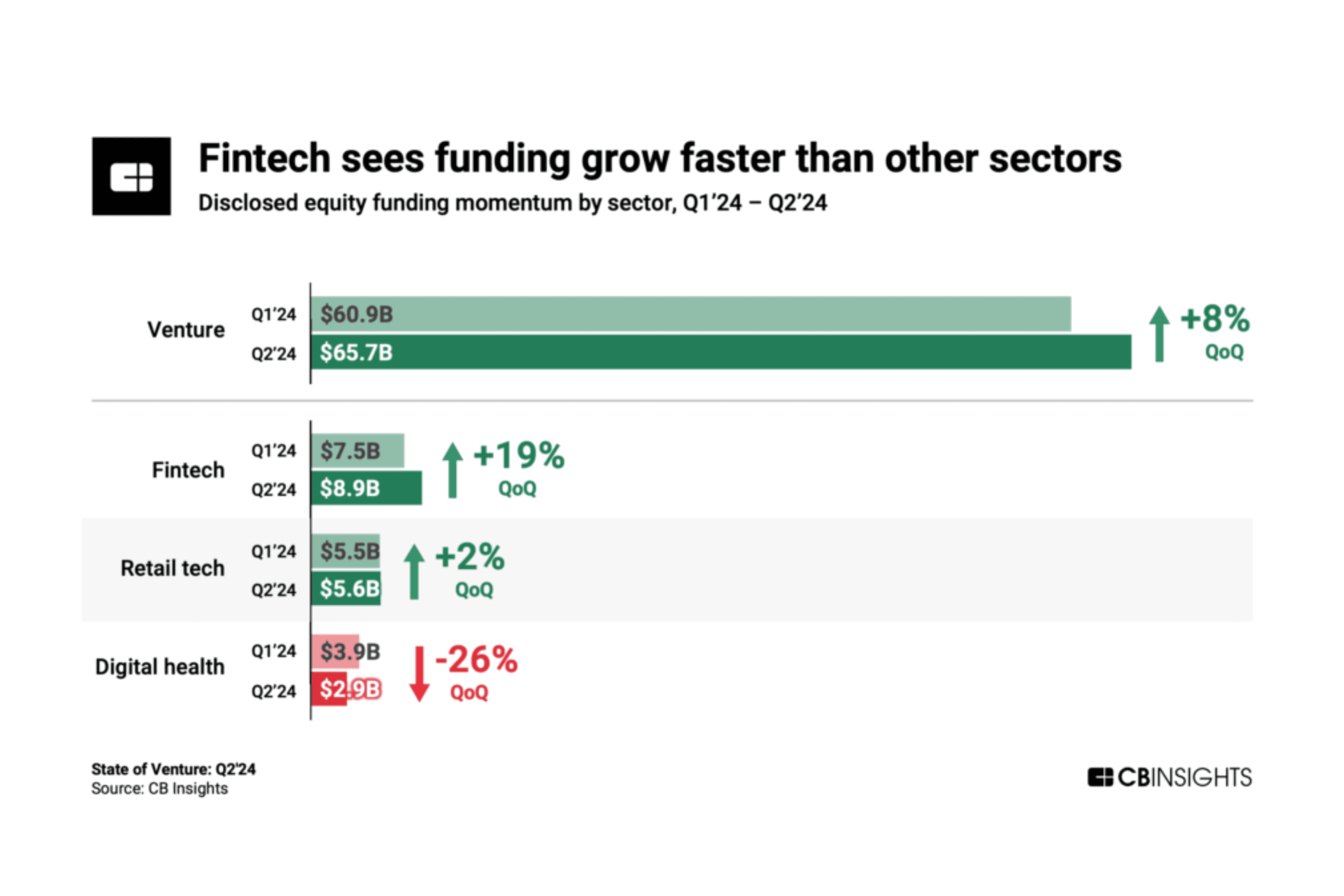

FinTech

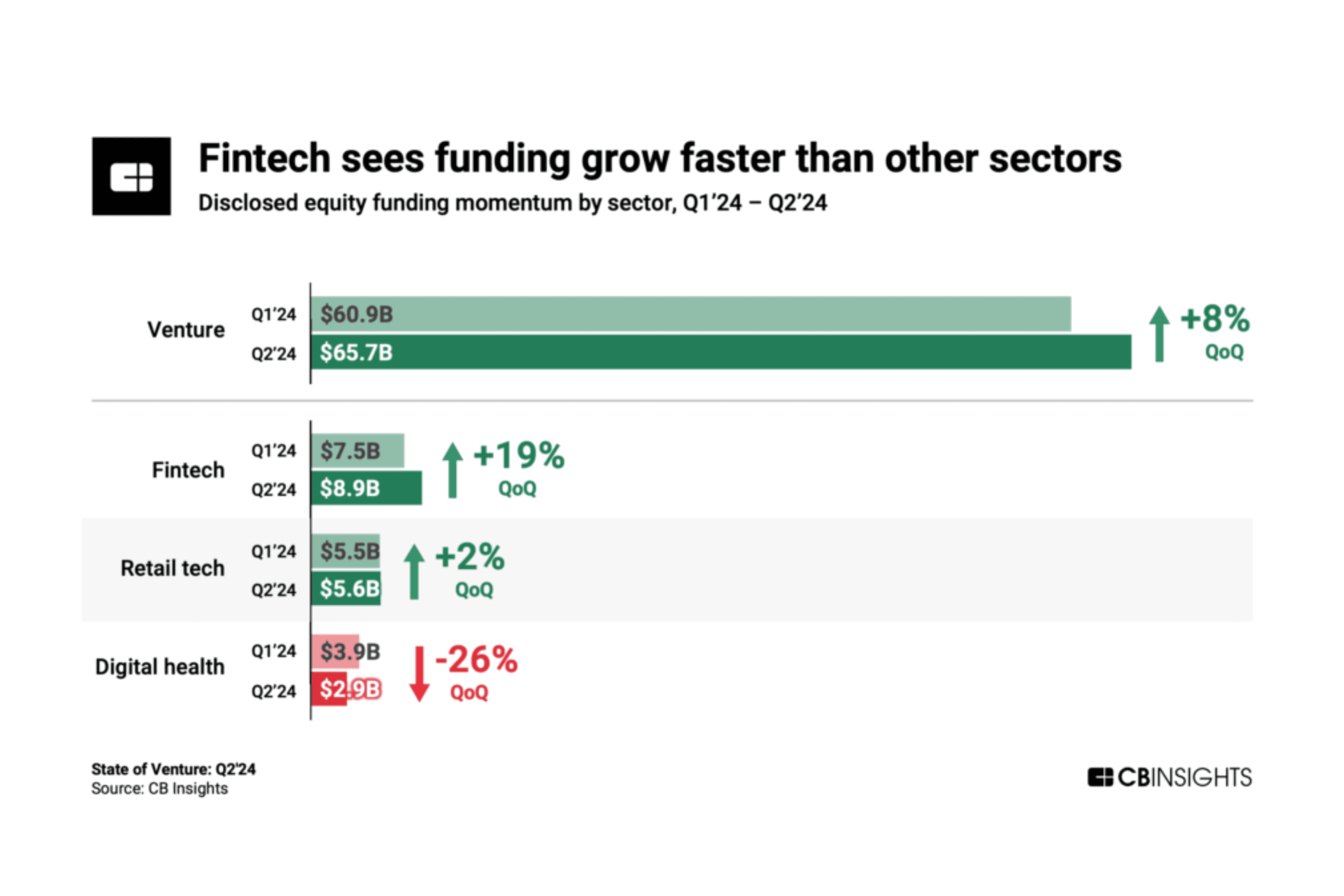

FinTech has shown robust growth with a 19% quarter-over-quarter increase in funding to $8.9 billion. Major investments include payments giant Stripe and market intelligence firm AlphaSense. This rebound highlights FinTech’s strong performance and resilience.

Source: CBInsights

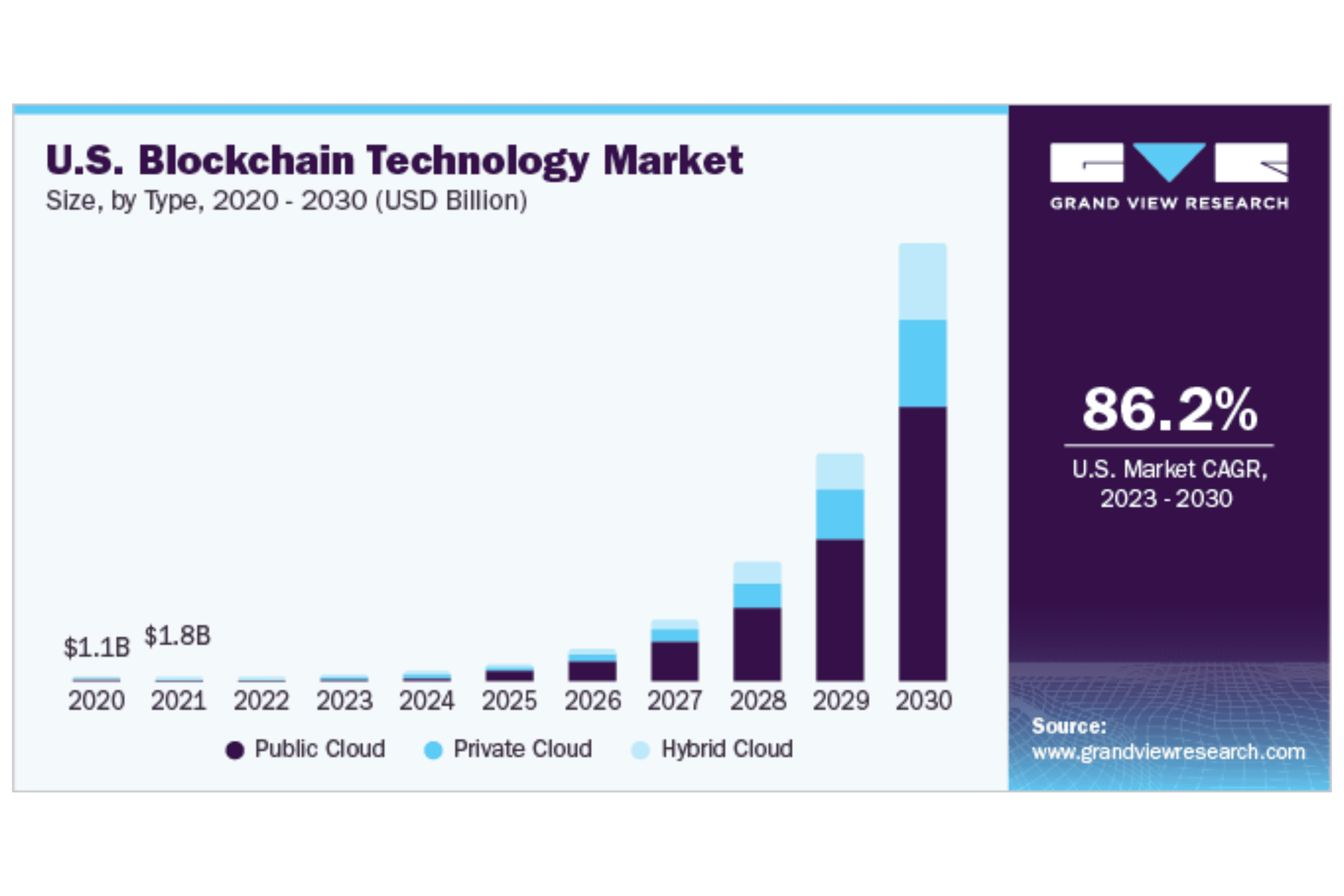

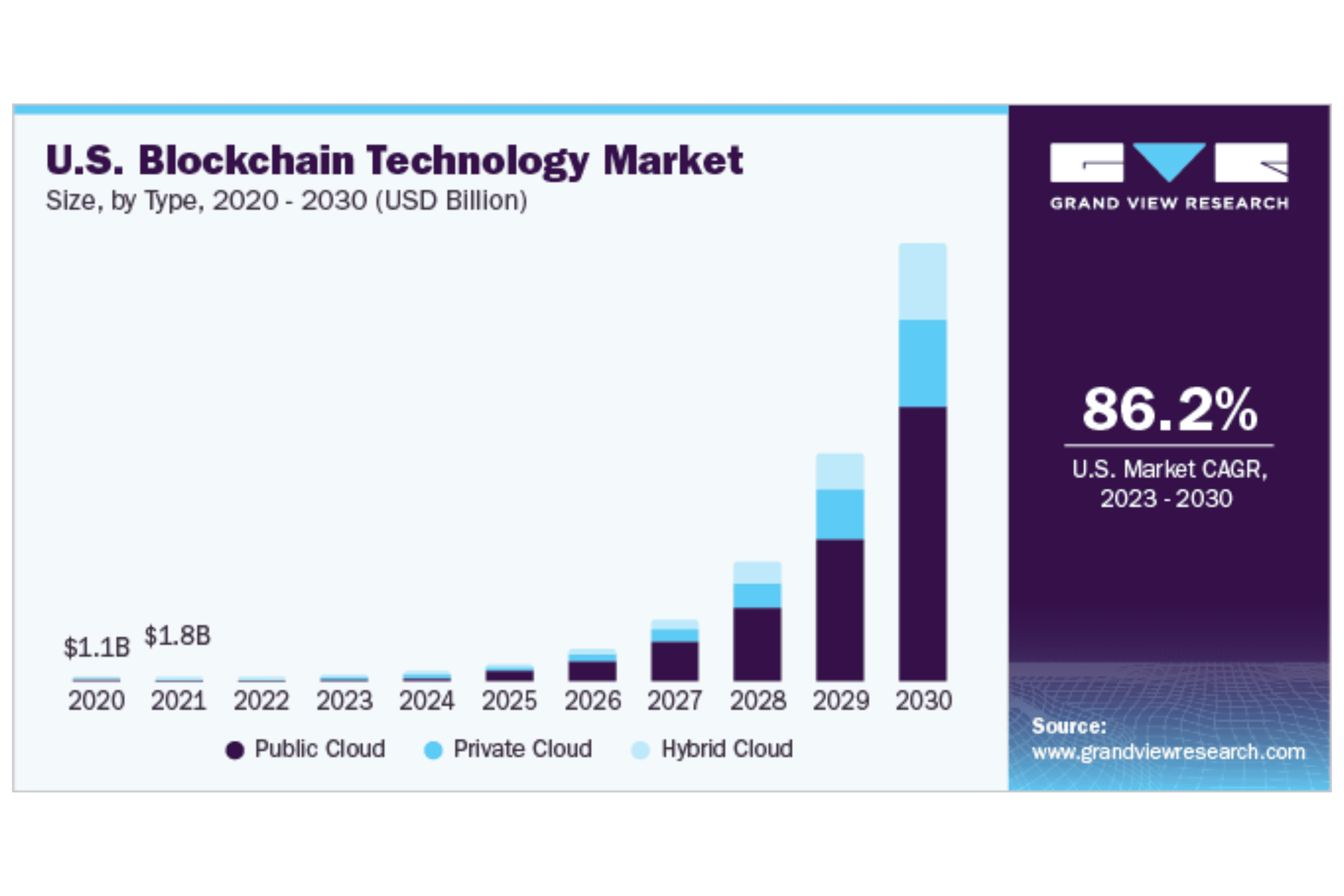

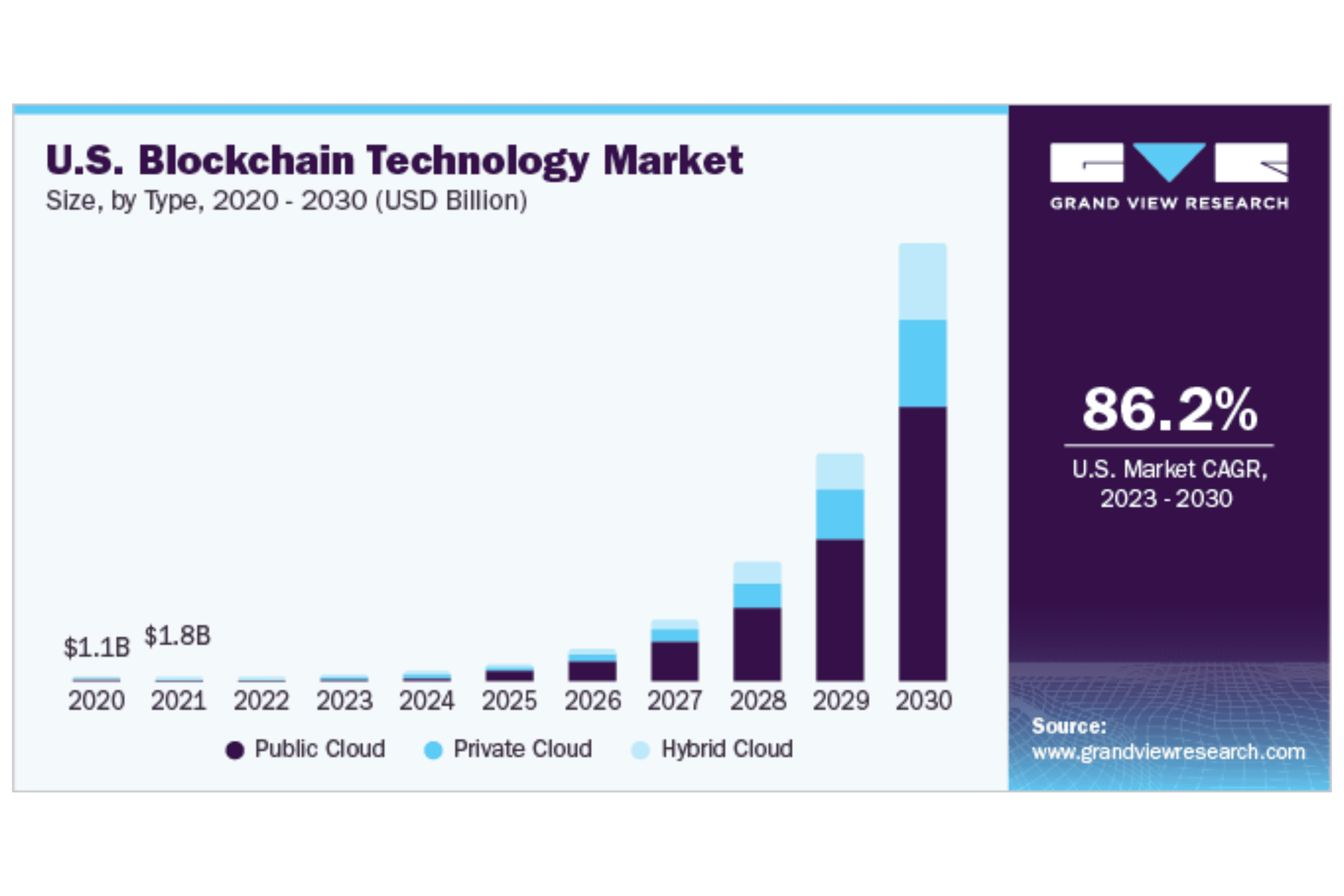

Blockchain Technologies

The blockchain market is expanding rapidly, with significant M&A activity and innovations such as in asset tokenization. Valued at $17.57 billion in 2023, the market is projected to reach $27.84 billion in 2024 and $825.93 billion by 2032, growing at a CAGR of 87.7%

Source: Grand View Research

In an era of rapid technological advancement, identifying high-growth sectors is crucial for institutional investors seeking to maximize returns. Key areas to focus on include:

AI

AI startups are driving substantial gains. In Q2 2024, AI-focused startups secured $23.2 billion, capturing 35% of global VC, a record high. Notably, Elon Musk’s xAI raised $6 billion and is valued at $24 billion, reflecting AI's central role in future investments.

Source: CBInsights

FinTech

FinTech has shown robust growth with a 19% quarter-over-quarter increase in funding to $8.9 billion. Major investments include payments giant Stripe and market intelligence firm AlphaSense. This rebound highlights FinTech’s strong performance and resilience.

Source: CBInsights

Blockchain Technologies

The blockchain market is expanding rapidly, with significant M&A activity and innovations such as in asset tokenization. Valued at $17.57 billion in 2023, the market is projected to reach $27.84 billion in 2024 and $825.93 billion by 2032, growing at a CAGR of 87.7%

Source: Grand View Research

In an era of rapid technological advancement, identifying high-growth sectors is crucial for institutional investors seeking to maximize returns. Key areas to focus on include:

AI

AI startups are driving substantial gains. In Q2 2024, AI-focused startups secured $23.2 billion, capturing 35% of global VC, a record high. Notably, Elon Musk’s xAI raised $6 billion and is valued at $24 billion, reflecting AI's central role in future investments.

Source: CBInsights

FinTech

FinTech has shown robust growth with a 19% quarter-over-quarter increase in funding to $8.9 billion. Major investments include payments giant Stripe and market intelligence firm AlphaSense. This rebound highlights FinTech’s strong performance and resilience.

Source: CBInsights

Blockchain Technologies

The blockchain market is expanding rapidly, with significant M&A activity and innovations such as in asset tokenization. Valued at $17.57 billion in 2023, the market is projected to reach $27.84 billion in 2024 and $825.93 billion by 2032, growing at a CAGR of 87.7%

Source: Grand View Research

Unlocking New Investment Opportunities While Navigating Risks

Unlocking New Investment Opportunities While Navigating Risks

Unlocking New Investment Opportunities While Navigating Risks

Investing in frontier technologies offers high potential returns but comes with substantial risks. Institutional investors need to balance these aspects to make informed decisions that maximize returns while managing risks.

Opportunities:

High Returns on Early Investments: Early-stage investments in breakthrough technologies can yield substantial returns.

Regulatory Clarity & First-Mover Advantage: Defined regulations provide opportunities for first-movers to gain market share and leadership.

Innovation Leadership & Market Share: Investing in innovative companies can capture significant market share and set industry standards.

Positive Impact & Sustainability Leadership: Technologies aligned with ESG principles offer opportunities for positive social impact and enhance reputations.

Risks:

Market Volatility: Emerging tech sectors can experience extreme fluctuations, requiring robust risk management strategies.

Regulatory Uncertainty: Evolving regulations, especially in AI and blockchain, create uncertainty that investors must navigate.

Technological Obsolescence: Rapid innovation can quickly render technology outdated, necessitating continuous monitoring and strategic adjustments.

Security & Ethical Concerns: New technologies often raise security and ethical issues that must be addressed to maintain confidence and ensure long-term viability.

”Investing in emerging markets offers some attractive opportunities for growth, diversification and impact. However, these opportunities come with significant challenges, including political risks, economic volatility and complex regulatory environments,” says Arunima Sharan, senior economist at OMFIF. “To navigate this terrain successfully, investors must adopt a nuanced approach that combines thorough risk management and strategic partnerships.”

Investing in frontier technologies offers high potential returns but comes with substantial risks. Institutional investors need to balance these aspects to make informed decisions that maximize returns while managing risks.

Opportunities:

High Returns on Early Investments: Early-stage investments in breakthrough technologies can yield substantial returns.

Regulatory Clarity & First-Mover Advantage: Defined regulations provide opportunities for first-movers to gain market share and leadership.

Innovation Leadership & Market Share: Investing in innovative companies can capture significant market share and set industry standards.

Positive Impact & Sustainability Leadership: Technologies aligned with ESG principles offer opportunities for positive social impact and enhance reputations.

Risks:

Market Volatility: Emerging tech sectors can experience extreme fluctuations, requiring robust risk management strategies.

Regulatory Uncertainty: Evolving regulations, especially in AI and blockchain, create uncertainty that investors must navigate.

Technological Obsolescence: Rapid innovation can quickly render technology outdated, necessitating continuous monitoring and strategic adjustments.

Security & Ethical Concerns: New technologies often raise security and ethical issues that must be addressed to maintain confidence and ensure long-term viability.

”Investing in emerging markets offers some attractive opportunities for growth, diversification and impact. However, these opportunities come with significant challenges, including political risks, economic volatility and complex regulatory environments,” says Arunima Sharan, senior economist at OMFIF. “To navigate this terrain successfully, investors must adopt a nuanced approach that combines thorough risk management and strategic partnerships.”

Investing in frontier technologies offers high potential returns but comes with substantial risks. Institutional investors need to balance these aspects to make informed decisions that maximize returns while managing risks.

Opportunities:

High Returns on Early Investments: Early-stage investments in breakthrough technologies can yield substantial returns.

Regulatory Clarity & First-Mover Advantage: Defined regulations provide opportunities for first-movers to gain market share and leadership.

Innovation Leadership & Market Share: Investing in innovative companies can capture significant market share and set industry standards.

Positive Impact & Sustainability Leadership: Technologies aligned with ESG principles offer opportunities for positive social impact and enhance reputations.

Risks:

Market Volatility: Emerging tech sectors can experience extreme fluctuations, requiring robust risk management strategies.

Regulatory Uncertainty: Evolving regulations, especially in AI and blockchain, create uncertainty that investors must navigate.

Technological Obsolescence: Rapid innovation can quickly render technology outdated, necessitating continuous monitoring and strategic adjustments.

Security & Ethical Concerns: New technologies often raise security and ethical issues that must be addressed to maintain confidence and ensure long-term viability.

”Investing in emerging markets offers some attractive opportunities for growth, diversification and impact. However, these opportunities come with significant challenges, including political risks, economic volatility and complex regulatory environments,” says Arunima Sharan, senior economist at OMFIF. “To navigate this terrain successfully, investors must adopt a nuanced approach that combines thorough risk management and strategic partnerships.”

Shape the Future at Digital Visionaries Symposium 2024

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Shape the Future at Digital Visionaries Symposium 2024

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Shape the Future at Digital Visionaries Symposium 2024

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights

& Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong